Award Set up

Managing a single budget year of training grant is challenging enough, but on a T32, it is possible to have funds in play from two separate budget years at the same time! Use a spreadsheet to effectively track trainees appointments and expenses.Project and Tasks

Oracle will set-up ONE PPM with 4 tasks:

NOT all PPM's adhere to this model of set up because of the legacy/ORACLE conversion. Please check your PPM accordingly.

- Training Related Expenses (TRE) or Basic Task

- Stipends

- Tuition/Fees

- Childcare Costs

NOT all PPM's adhere to this model of set up because of the legacy/ORACLE conversion. Please check your PPM accordingly.

Revenue (Budget Allocation)

- Sponsored Projects Finance (SPF) will add the initial budget allocation (STaRT log in required) to the operating ledger.

- Check the awarded amounts to the correct tasks.

- This is important because there are strict re-budgeting guidelines that pertain to training grants.

- Calculate 8% burden rate for training related expenses and stipends only – the burden rate listed is only for these two categories – make sure the allocation of IDC is correctly split between the two tasks.

- Restricted Balances:

- This can arise when a unused balance occurred in a prior year.

- Check the top left of the PPM if "Restricted Balances" has a dollar amount next to it.

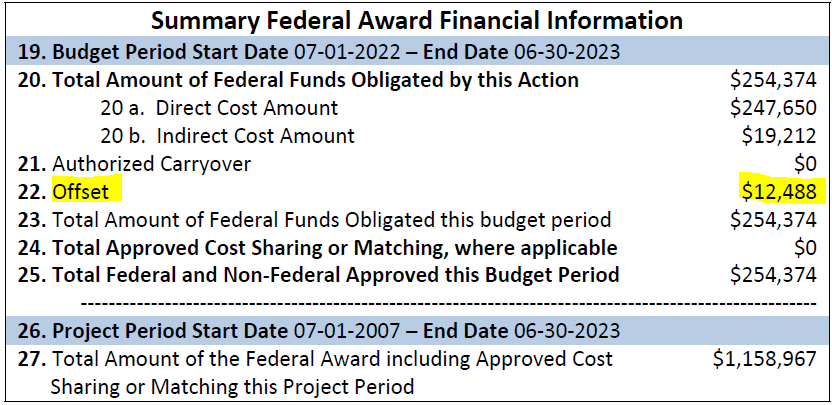

- NIH may offset any unused funds in future years NOA's

Offset Example on Notice of Award (NOA)

- If an offset occurs, SPF will release the restricted balance per the NOA.

Training Related Expenses (TRE)

Training Related Expenses (TRE) are similar to "institutional support" if awarded as an individual fellowship (F Series)

Allowable

Allowable

- Predoc Health Insurance

- Expenditure Type on PPM - 531200-GSHIP Self-Insurance

- Postdoc Health Insurance

- Admin Salaries

- Meeting meals

- Speaker Fees

- Supplies

- HSIT and NGN

- Cannot be carried forward to next budget year - without prior approval from agency.

- At the end of the budget year, usually any unspent TRE's are lost.

- Often trainees appointments cross two budget years but if the these costs are not incurred before the end of the budget year, they will be lost.

Travel

Allocated in the training related expenses (TRE) task (i.e. Task 1)

Allowable

Allowable

- Foreign travel

- Scientific Meetings

- Travel to a research training experience away from the recipient organization may be permitted with prior approval.

- Trainees must be appointed to the training grants at time of the actual travel for this to be an allowable cost.

- Travel expenses cannot be listed as unliquidated expense if the actual travel did not occur within the budget period.

- Only an actual charge for travel that has been incurred but not yet paid (encumbrance) before the end of a budget period may be reported as an unliquidated obligation.

NGN

NGN follows Postdoc Stipends (no NGN for predocs)

- NGN must be moved from the stipends task to TRE task.

- NGN can be redirected if you submit an ITS services & support ticket at the beginning of each project period for each trainee.

- If it is not redirected, then the fund manager must ensure these charges are appropriately moved via a cost transfer or by SPF at the time of the annual FER.

Health Sciences IT Charges (HSIT)

HSIT follow Postdoc Stipends

- HSIT must be moved manually from stipend task to TRE task.

- HS Technology Services Charge or SOM IT Shared Services R3 Recharge.

- Does not apply to SIO or General Campus

- 770001 - HSIT VCHS Shared Svc - Debit

- 770002 - HSIT VCHS Shared Svc - Debit

Stipends

Predocs

Fellows/Trainees must be in UCPath by July 1, 2024Predoc stipends are in transition from being processed through the financial support request tool (FSRT) and the student aid management (SAM) system to the FSPT system - financial support payments system (FSPT) tool.

FSRT - Stipends appear on the GL with a PID (Student ID #) and no name. In order to reconcile, you will need the PID number. This can be obtained from the home dept or in the BAH from the graduate student funding report (access permitting).

Expenditure Type on PPM - 511002 - Graduate and Postdoc Aid/Fellowship

FSPT - Stipends will be on the general ledger as payroll expenses because they are processed through UC Path and will have the employee (trainee) name next to the expense. FSPT Job setup.

Postdocs

Postdoc stipends are listed on the PPM or GL as payroll expenses.

Since benefits (CBR's) follow stipends but are not allowed on the stipend task, ALL postdoc benefits will need to be moved off. Allowable expenses can be moved to the TRE task, while unallowable benefits must be moved to a discretionary fund source. Since NGN and HSIT follow benefits, they will also need to be moved to the TRE task.

Position - POSTDOC-FELLOW

Expenditure Type on PPM - 511002 - Graduate and Postdoc Aid/Fellowship

Resident Physicians

Clinical Resident stipends are listed on the PPM or GL as payroll expenses. Benefits may be charged directly to TRE since Graduate Medical Education (GME) sets up benefits differently than a postdoc researchers.

Position - RESID PHYS/SUBSPEC

Tuition and Fees

Predocs

Predoc fees appear on the PPM with a PID (Student ID #) and no name. In order to reconcile, you will need the PID number. This can be obtained from the home dept or in the BAH from the graduate student funding report (access permitting).

FSRT - Expenditure Type on PPM - 511003 - Graduate Tuition and Fees (not fee remission)

Predoc Health Insurance - GSHIP 531200 - should be charged to TRE Task not tuition/fee task.

Postdocs

Predoc fees appear on the PPM with a PID (Student ID #) and no name. In order to reconcile, you will need the PID number. This can be obtained from the home dept or in the BAH from the graduate student funding report (access permitting).

FSRT - Expenditure Type on PPM - 511003 - Graduate Tuition and Fees (not fee remission)

Predoc Health Insurance - GSHIP 531200 - should be charged to TRE Task not tuition/fee task.

Postdocs

Expenditure Type on PPM - 772001 - Unex Recharge-Class Fee Debit

Childcare Costs

- NIH will provide the annual childcare costs (currently $3,000) for 25% of the full-time predoctoral or postdoctoral NRSA training appointment slots - see NOT-OD-25-100

- If your grant exceeds the 25% allocation you can request supplemental funds under the prior approval function in eRA commons. NOT-OD-25-165

- Childcare costs are excluded from modified total direct costs and are not subject to IDC.

- Unused childcare funds cannot be rebudgeted and must be reported as an unobligated balance on the annual Federal Financial Report (FFR). NIH will offset any unused funds in future years.

- However, for trainee appointments that cross over budget periods it may be reported as unliquidated obligations.

- In cases of early termination, recipients may not use any unused portion of the childcare costs.

- Clinical Trainees (GME Residents and Fellows) are not eligible for the NRSA Childcare reimbursement due to their participation in the SDHSA collective bargaining unit.

- If you are funded by a NRSA (NIH) fellowship or training grant (F30, F31, F32, F33, TL1 or T32, contact your mentor or fund manager to start your childcare reimbursement request through Concur.

8% Burden Rate (IDC)

How is the burden rate (IDC) calculated on a Training Grant?

- Calculate the 8% burden rate for training related expenses (TRE) and stipends tasks only.

- Exclude IDC from childcare expenses and tuition/fees.

- Be sure the allocation of IDC is correctly split between TRE and stipends tasks.

- Expenditure Type on PPM - 538000 FandA IDC Expense